-

State Tax Service

of Ukraine - Service

- Activity

- Legislation

- Public relations

- Press Center

- Contacts

- Home

- Press Center

- News

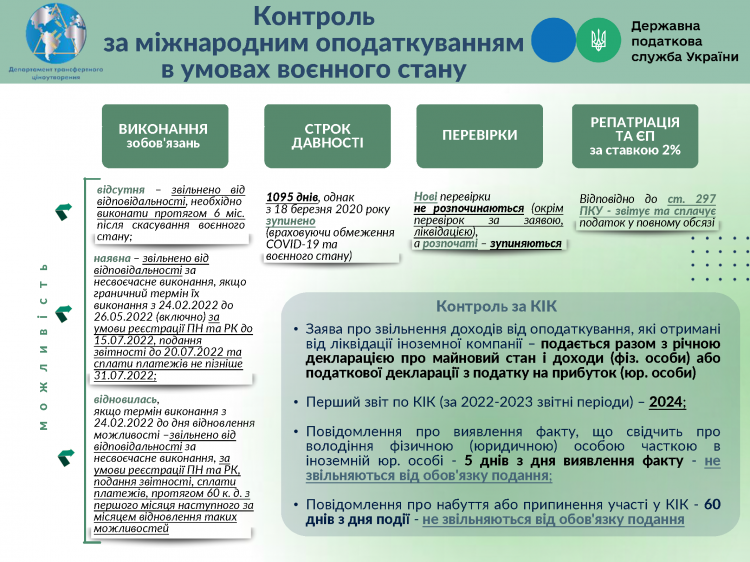

- Peculiarities of control over international taxation in the martial law conditions

Peculiarities of control over international taxation in the martial law conditions

To ensure interaction with taxpayers, the State Tax Service of Ukraine informs about rights and obligations of taxpayers and supervisory authorities in matters of international taxation (taxation of non-resident incomes, control over controlled foreign companies and non-residents).

1. Regarding submission of the PN annex to the income tax declaration and liability of payers for violations of tax legislation

According to requirements of Paragraph 103.9 Article 103 of the Tax Code of Ukraine № 2755-VI as of 02.12.2010 with changes and amendments (hereinafter – Code), reporting to the tax authority on taxes withheld and paid to the budget from income of non-residents is a responsibility of persons who pay such income. Such reporting is the PN annex to the corporate income tax declaration.

Sub-paragraph 141.4.2 Paragraph 141.4 Article 141 of the Code stipulates that persons who submit reporting are residents, including individuals-entrepreneurs, individuals who conduct independent professional activities or business entities (legal entities or individuals-entrepreneurs) who chose the simplified taxation system or other non-residents who conduct business through a permanent representative office on the territory of Ukraine, who make any payment in favor of non-resident or person authorized by him / her from income with a source of its origin in Ukraine received by such non-resident (including to non-resident accounts made in the national currency).

Temporarily, for a period until termination or abolition of the martial law on the territory of Ukraine, administration of taxes and levies is carried out taking into account specifics defined in Sub-paragraph 69.1 Paragraph 69 Sub-section 10 Section XX "Transitional Provisions" of the Code (amended by the Law № 2260 as of 12.05.2022).

For taxpayers, the legislative changes provide for peculiarities of paying taxes in the following situations:

- payer does not have opportunity to fulfill tax obligation in a timely manner – such payer is exempted from responsibility but is obliged to fulfill such obligation within 6 months after termination or abolition of the martial law;

- payer has opportunity to fulfill tax obligation in a timely manner - such payer is exempted from responsibility for late fulfillment of such obligations deadline for fulfillment of which falls on a period from 24.02.2022 to 27.05.2022, provided that tax invoices and adjustment calculations are registered by July 15, 2022, tax declarations are submitted by July 20, 2022 and taxes and levies are paid not later than July 31, 2022;

- payer has regained ability to fulfill tax obligations term of which falls on a period from 02.24.2022 to the day of restoration of ability - such payer is exempted from responsibility for untimely fulfillment of such obligations, provided that tax invoices and adjustment calculations are registered, reporting is submitted, taxes and levies are paid within 60 calendar days from the first month following the month of renewal of such opportunities.

Please note that confirmation of the possibility or impossibility of the taxpayer's fulfillment of obligations will be carried out according to a separate Procedure, which will be approved by the Ministry of Finance of Ukraine.

Herewith, Paragraph 521 Sub-section 10 Section XX "Transitional Provisions" of the Code stipulates that for violations of tax legislation, committed during a period from March 1, 2020 to the last calendar day of the month (inclusively), in which quarantine established by the Cabinet of Ministers of Ukraine on the entire territory of Ukraine to prevent spread of the coronavirus disease (COVID-19) on the territory of Ukraine ends, penalties are not applicable.

2. Statute of limitations

According to requirements of Paragraph 102.1 Article 102 of the Code, the total statute of limitations for conducting audits and determining amount of monetary liabilities for the supervisory authority and the taxpayer is 1095 days (3 years), which comes after the last day of the deadline for submitting tax declaration and/or the deadline for payment of monetary obligations charged by the supervisory authority and if such tax declaration was submitted later, after the day of its actual submission.

If the taxpayer submits clarification calculation to tax declaration or clarification declaration, period of 1095 days is calculated from the date of submission of clarification calculation (declaration), within the limits of submitted clarifications.

Paragraph 522 Sub-section 10 Section XX "Transitional Provisions" of the Code (as amended by the Law № 591-IX as of 13.05.2020) stipulates that for a period from 18.03.2020 to the last calendar day of the month (inclusively), in which quarantine established by the Cabinet of Ministers of Ukraine on the entire territory of Ukraine to prevent spread of the coronavirus disease (COVID-19) on the territory of Ukraine ends, the statute of limitations provided for Article 102 of the Code is suspended.

However, Paragraph 522 Sub-section 10 Section XX "Transitional Provisions" of the Code is suspended for a period of the martial law and state of emergency (amended by the Law of Ukraine № 2120-IX as of 15.03.2022).

Herewith, according to requirements of Paragraph 102.9 Article 102 of the Code (as amended by the Law of Ukraine № 2120-IX as of 15.03.2022), expiration of the statute of limitations for a period of the martial law, state of emergency for payers and the supervisory authority is suspended.

As follows, the statute of limitations regarding the non-resident’s income taxation has been suspended since 18.03.2020.

3. Regarding conduction of audits on taxation issues of non-residents’ income

During the martial law in Ukraine, tax audits are not started and audits that have been started are stopped, except for unscheduled documentary audits carried out at the taxpayer’s request and/or for reasons, defined, in particular, by Sub-paragraph 78.1.7 Paragraph 78.1 Article 78 of the Code in terms of taxation of non-resident incomes (Sub-paragraph 69.2 Paragraph 69 Sub-section 10 Section XX "Transitional provisions" of the Code).

It should also be noted that for audits that have been completed, deadlines for submitting objections to the audit act and appealing tax notifications-decisions are also suspended for a period of the martial law in Ukraine.

At the same time, due to audits stopped according to the above-mentioned norms of the Code, deadlines for conducting such audits are also suspended.

4. Regarding the single tax at 2% interest rate

According to requirements of Paragraph 9 Sub-section 8 Section XX "Transitional Provisions" of the Code, the taxpayers had opportunity to voluntarily change taxation system from the general to Group III of the single tax at 2% income rate.

However, according to Paragraph 297.5 Article 297 of the Code, single tax payers who make payments from income of non-residents with a source of origin from Ukraine, calculate and pay tax on this income, submit reporting in manner, amount and terms established by Section III of the Code.

5. Control over controlled foreign companies (abbreviation – KIK)

KiK’s income taxation rules are established by Article 392 of the Code. They provide that Ukrainian residents (both individuals and legal entities) who own companies in other countries (or actually control them) will be required to pay tax in Ukraine on the undistributed profits of such companies.

Foreign company will be considered a KIK in Ukraine if:

- share that tax resident of Ukraine (legal entity or individual) owns in such company is more than 50% or more than 10% (provided that, in total, residents of Ukraine own a share of 50% or more in such KIK); or

- tax resident of Ukraine (legal entity or individual) exercises "actual control" over such foreign company (independently or together with other tax residents of Ukraine).

Actual control takes place in the presence of at least one of circumstances specified in the Code. Such circumstances are, for example, provision of binding instructions by person to the management bodies of foreign company, ability to carry out or block transactions on the bank account of such foreign company and others.

Law of Ukraine № 1117-IX as of 07.12.2020 "On amendments to the Tax Code of Ukraine and other laws of Ukraine regarding ensuring collection of data and information necessary for declaring certain taxation objects" Paragraph 54 Sub-section 10 Section XX of the Code is set out in the following wording: the specifics of application of provisions on the income taxation of controlled foreign company during the transition period are established, in particular, for the first reporting (tax) year for reporting on controlled foreign companies is 2022 (if the reporting year does not correspond to a calendar year – reporting period starts in 2022). Controlling persons have a right to submit a report on controlled foreign companies for 2022 to the supervisory authority at the same time as submitting annual property and oincome tax declaration or corporate income tax declaration for 2023 with inclusion of adjusted income of controlled foreign company, subject to taxation in Ukraine, specified in such report, to the indicators of relevant declarations for 2023.

Paragraph 14 Sub-section 1 Section XX of the Code stipulates that the taxpayer submits to the supervisory authority simultaneously with tax declaration for the corresponding tax (reporting) year an application for exemption of such income from taxation compiled in an arbitrary form.

Declarations and applications on the application of benefit, which consists in the exemption from personal income taxation of income received from the liquidation of foreign company, for 2021 are submitted to the supervisory authority according to Sub-paragraph 69.1 Paragraph 69 Sub-section 10 Section XX of the Code.

Sub-paragraph 392.5.5 Paragraph 392.5 Article 392 of the Code stipulates that individual - resident of Ukraine or legal entity - resident of Ukraine sends to the supervisory authority a Notification of acquisition or termination of participation in controlled foreign companies within 60 days from the day of such acquisition (start of actual control) or alienation (termination of actual control). Obligation of such submission remains to this day.

Order of the Ministry of Finance of Ukraine № 512 as of 22.09.2021 approved the Form and Procedure for sending the Notification of acquisition to the supervisory authority (start of actual control) or alienation of share (termination of actual control) by resident in the foreign legal entity or property rights to the share in assets, income or profit of entity without the legal entity’s status.

To date, Sub-paragraph 392.6.3 Paragraph 392.6 Article 392 of the Code stipulates that any supervisory authority, other state authority, bank or financial institution that has discovered facts indicating that individual - resident of Ukraine owns share in the foreign legal entity, sends the Notification of this to the State Tax Service by electronic communication means not later than five working days from the day of discovery of the specified facts.

Information is provided taking into account the Laws on amendments to the Tax Code of Ukraine № 2118-IX as of 03.03.2022 (entered into force on 07.03.2022), as of 15.03.2022 № 2120-IX (entered into force on 17.03.2022), as of 24.03.2022 № 2142-IX (entered into force on 04.05.2022), as of 01.04.2022 № 2173-IX (entered into force on 16.04.2022), as of 12.05.2022 №2260-ІХ (entered into force on 27.05.2022).