Simplification of procedures for business operations: number of risky payers has almost halved, blocked invoices – almost quadrupled

Press service of the State Tax Service of Ukraine , published 19 December 2025 at 11:33 Chapter: News

State Tax Service simplifies procedures for business operations. Number of risky taxpayers has almost halved and number of suspended tax invoices has almost quadrupled this year. This was informed by acting Head of the State Tax Service Lesya Karnaukh.

“This is result of systematic work. We deliberately followed the path of simplifying procedures, constant communication with each payer” – she stated.

How does this look in numbers?

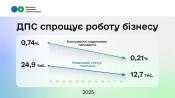

Suspension of tax invoices:

- beginning of 2025 – 0.74%,

- December 2025 – 0.21%.

And this despite the fact that business submitted 6.6% more tax invoices than the last year.

Blocking of tax invoices has topped the list of business complaints for years. Today, these are single appeals.

Payer’s risk status

- beginning of 2025 – 24.9 thousand.

- December 2025 – 12.7 thousand.

How did it work?

List of measures is considerable – from updating mechanisms to introducing the new services.

- Consultation centers and “hotlines” regarding registration suspension of tax invoices and taxpayer riskiness have been launched in territorial bodies.

- Tax Consultant Offices for all tax aspects have been opened.

- Approaches to the commissions’ work of territorial bodies of the State Tax Service have been updated.

- Regulatory changes

State Tax Service initiated changes to Resolution № 1165. Due to the Government’s support for our position, the automatic registration of tax invoices has become clearer and fairer.

And the most importantly, it reduced number of business entities that face block of tax invoices.

“Business needs predictable working conditions. And this is not about the lack of control, but about its effectiveness” – Lesya Karnaukh emphasized.