“Taxes protect”: story of a master tiler Mykhailo

Press service of the State Tax Service of Ukraine , published 16 December 2025 at 13:44 Chapter: News

Ministry of Finance of Ukraine, together with the State Tax Service of Ukraine, continue to describe life situations and importance of paying taxes within framework of the communication campaign “Taxes protect”.

Today is story of Mykhailo, who earns income as a master tiler. Read about what taxes Mykhailo pays on income from his activity.

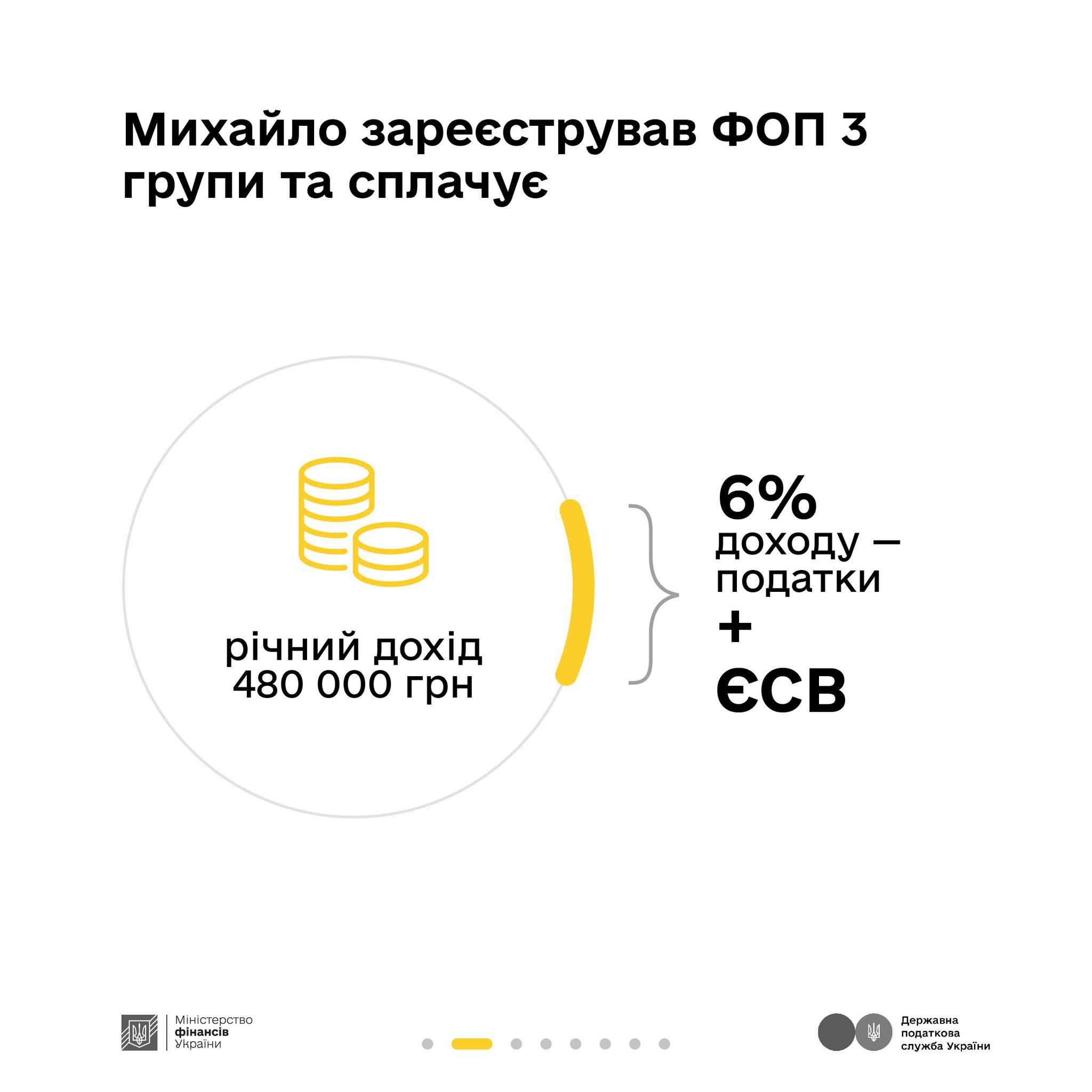

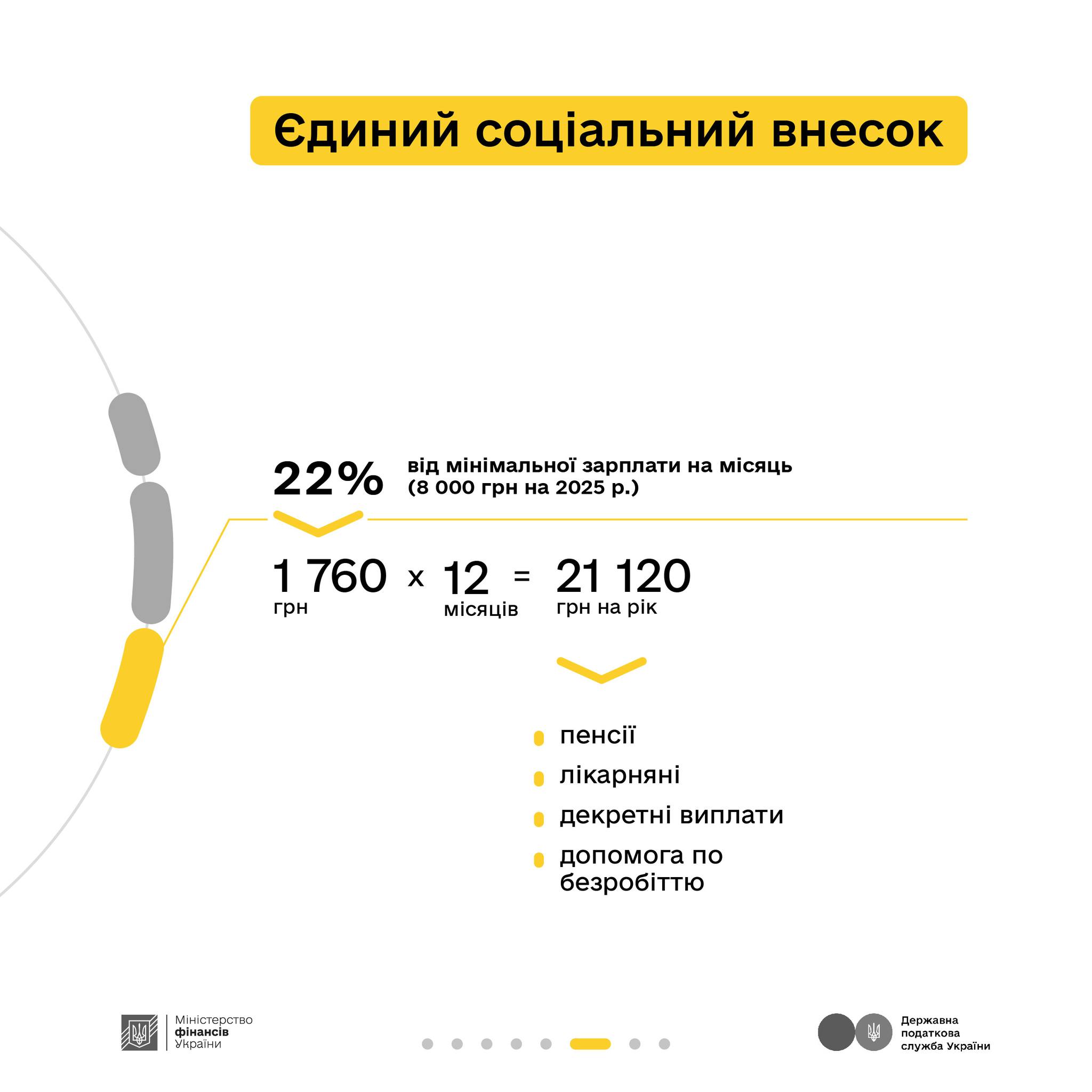

27-year-old Mykhailo is a master tiler. He finds his orders through the online ads and recommendations from previous clients. On average, Mykhailo earns about 40 thousand UAH per month (120 thousand UAH/quarter; 480 thousand UAH/year). Mykhailo has registered his activities as individual-entrepreneur of Group III. This allows him to officially provide tile laying services to both individuals and to cooperate with construction companies.

Every quarter, Mykhailo submits his tax declaration through the “Diia” app and pays taxes.

Result for the year looks like this:

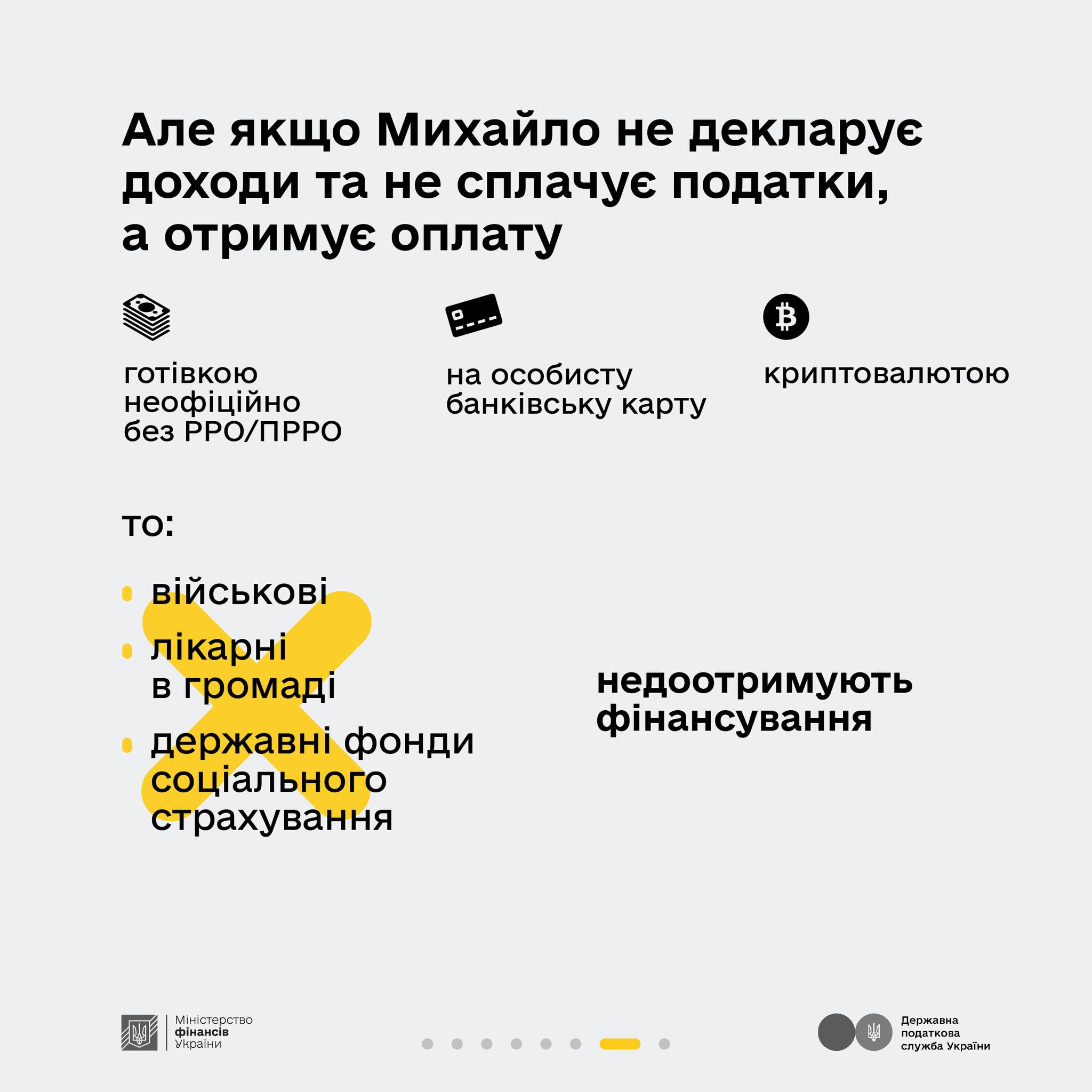

If Mykhailo receives payment for his services on a personal bank card, in cryptocurrency or in cash and does not declare it, it turns out that he does not pay income taxes.

Then:

- militaries will not have enough food for going out to positions,

- doctors will not do cardiogram for a patient in intensive care,

- state social insurance funds will not be replenished, therefore, Mykhailo will not receive appropriate payments if necessary.

Taxes protect. Help with your contribution!

Communication campaign is being implemented by the Ministry of Finance of Ukraine together with the State Tax Service with funding from the Great Britain’s Government through the Department of Foreign Affairs and International Development. Information presented in the campaign materials does not necessarily reflect views of the Great Britain’s Government.