“Taxes protect”: what taxes does a student tutor pay?

Press service of the State Tax Service of Ukraine , published 15 December 2025 at 10:25 Chapter: News

Ministry of Finance of Ukraine, together with the State Tax Service of Ukraine, continue information campaign “Taxes protect”. As a part of the ninth life story, we tell exactly what taxes student Lyudmila pays on income from tutoring

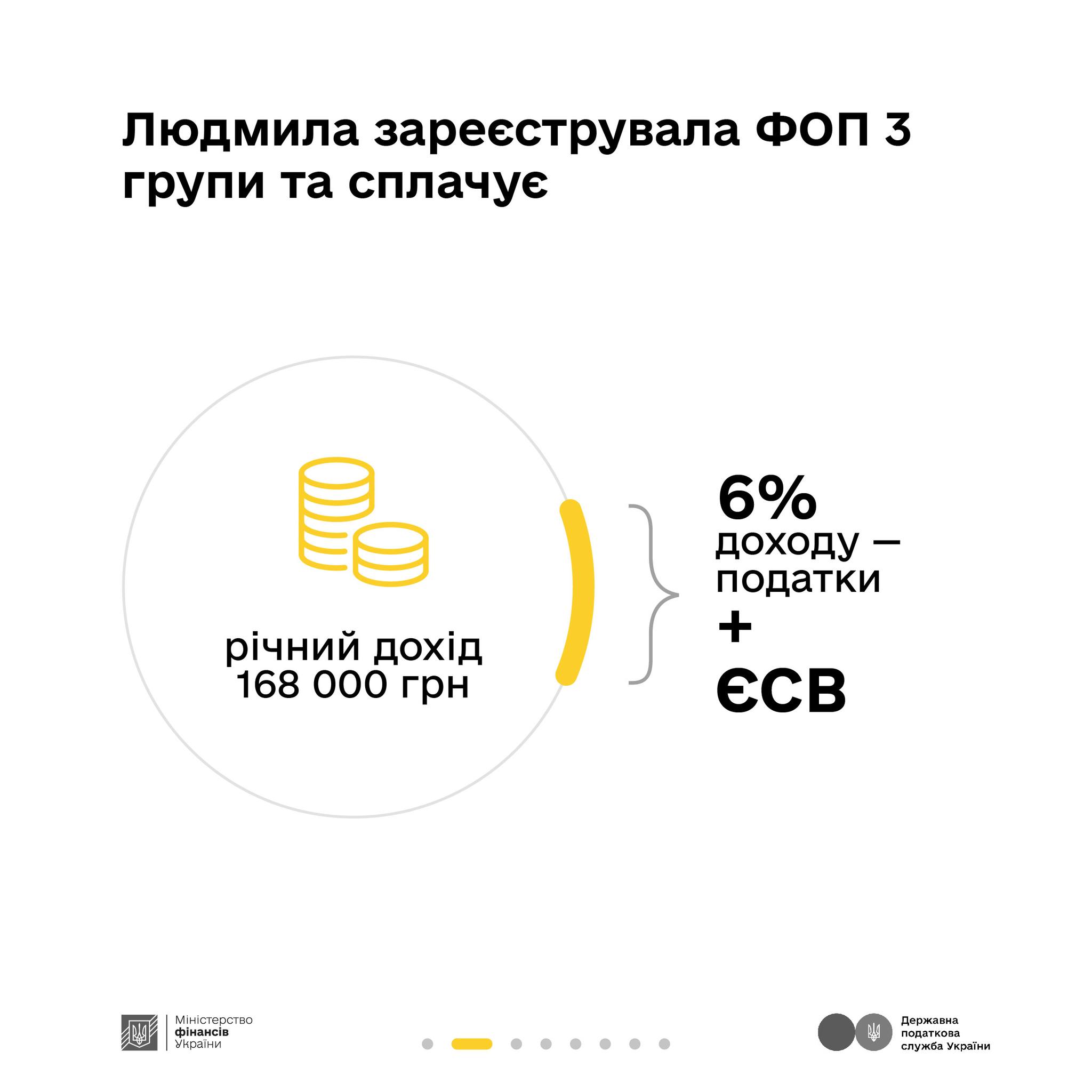

22-year-old Lyudmila is a 4th-year student majoring in Programming. In her free time, she works as a math tutor and prepares 11th-graders for the National Multi-Subject Test. She earns about 14 thousand UAH per month (42 thousand UAH per quarter; 168 thousand UAH per year). Lyudmila has registered her business as a group 3 individual-entrepreneur. This allows her to work not only with individual students, but also with schools and online platforms.

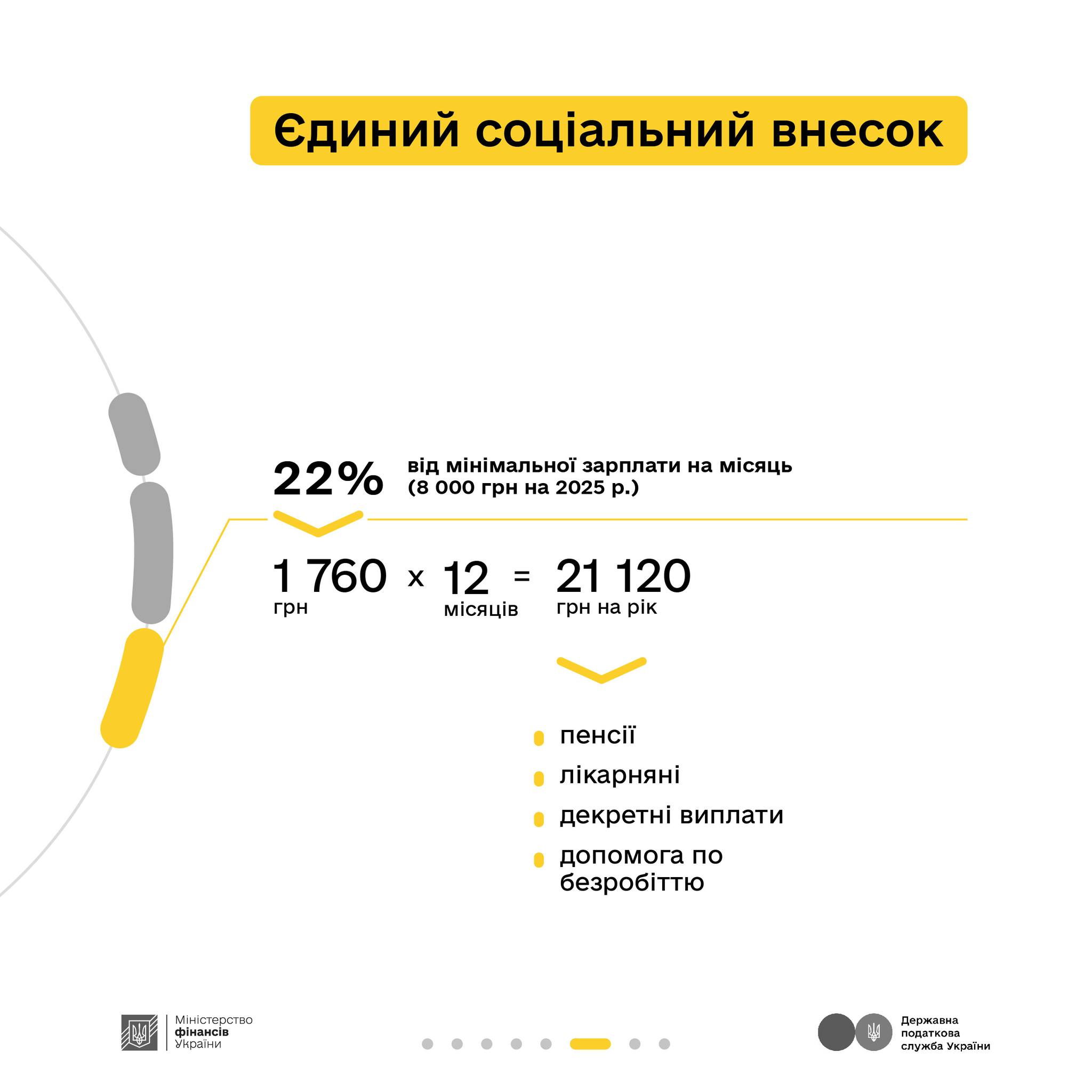

Every quarter, Lyudmila submits tax declaration through the “My Tax Service” app, pays taxes and obligatory insurance.

Result for the year looks like this:

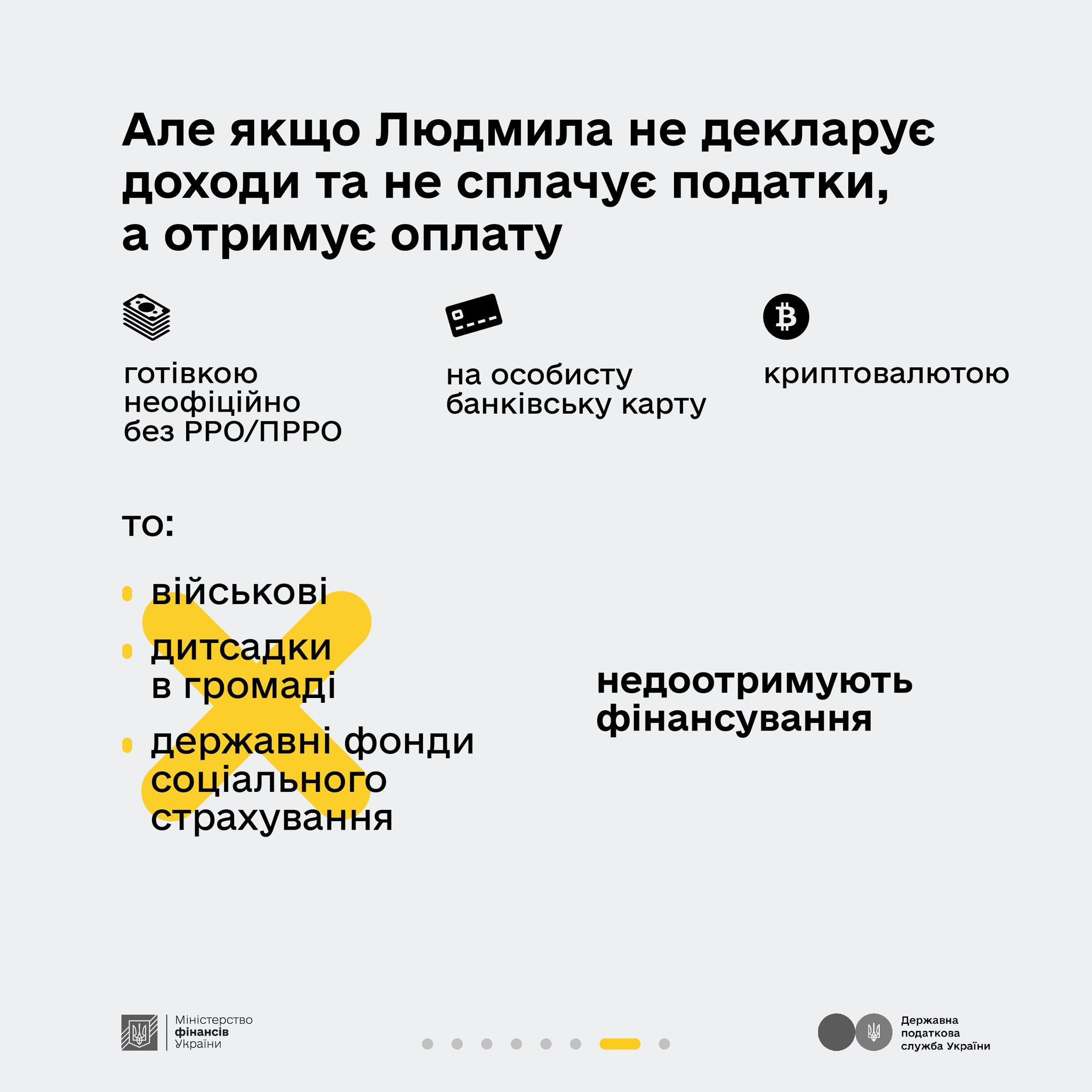

If Lyudmila receives payment for her tutoring services on a personal bank card, in cryptocurrency or in cash, does not declare it and does not pay income taxes, then:

- militaries will not have isothermal blankets to prevent hypothermia of a wounded comrade and save life,

- in kindergarten, children will not be able to spend quality time during walks,

- state social insurance funds will not be replenished, therefore, Lyudmila will not receive social insurance and relevant payments if necessary.

Taxes protect. Help with your contribution!

Communication campaign is being implemented by the Ministry of Finance of Ukraine together with the State Tax Service with funding from the Great Britain’s Government through the Department of Foreign Affairs and International Development. Information presented in the campaign materials does not necessarily reflect views of the Great Britain’s Government.